Design, Innovation, and Regional Competitiveness: Insights from the Milan Fashion Cluster

By Rania El Ghalbzouri (e-mail), Vida Asabea Ohene, Yasmine Didou, June Bunpha and Prof. Dr. Pablo Collazzo*, at the Business & Tourism Unit of Thomas More University of Applied Sciences, Mechelen, Belgium.

Introduction

This article offers a comprehensive examination of Milan’s fashion and luxury goods cluster, concentrating on its economic performance, business environment, historical development, and strategic recommendations for future growth. Milan, as a key economic pillar of Italy, plays a significant role in driving the country’s economic development, particularly through its dominant position in the fashion and luxury sectors. Lombardy, the region where Milan is located, accounts for 23% of Italy’s GDP. Despite recent inflationary pressures, the luxury goods industry remains resilient, contributing significantly to economic growth and employment.

Milan’s strategic location, advanced infrastructure, and robust intellectual property protections underscore its position as a global fashion hub. Renowned institutions such as Politecnico di Milano ensure a steady supply of skilled professionals, while events like Milan Fashion Week further elevate the city’s status in the international market. Despite global economic challenges, Milan continues to thrive, driven by innovation and adaptation to trends such as e-commerce, digital transformation, and sustainability.

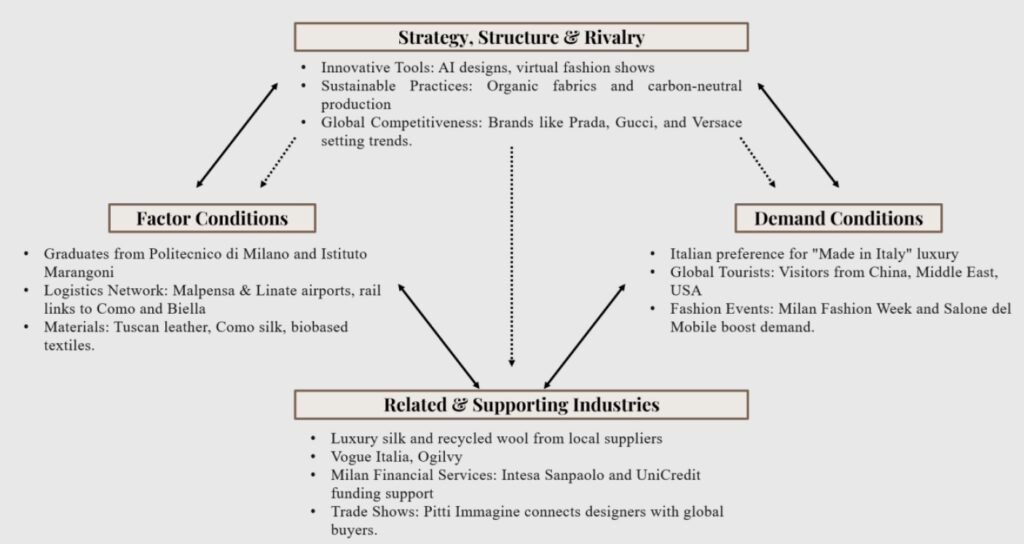

The article also employs Porter’s Diamond Model to analyse Milan’s competitive advantages and challenges. Key benefits include a highly skilled workforce, world-class institutions, and a robust network of related industries. At the same time, challenges such as high labour costs, market saturation, and rising environmental regulations threaten the sector’s growth potential.

The historical context highlights Milan’s evolution from a regional textile hub to a global fashion leader, underpinned by its rich heritage and continuous innovation. However, the current economic downturn, marked by a decline in exports, underscores the need for strategic adaptation. Milan’s fashion industry must diversify its offerings, invest in sustainability, and strengthen ethical practices to maintain its competitive edge.

The article concludes with actionable recommendations, including diversifying product lines to include affordable yet high-quality items, accelerating sustainable practices, and enhancing transparency and anti-corruption initiatives. Synergies with Italy’s creative and industrial sectors, as well as strengthening regional connections, will also be crucial in driving future growth and reinforcing Milan’s position as a leader in the global fashion and luxury market. Through these strategies, Milan’s fashion cluster can continue to thrive in an evolving global landscape.

Clusters and the Microeconomics of Competitiveness

According to Michael Porter (1990, 2008), competitiveness emerges not from low costs or natural endowments but from the productivity and innovation capacity of firms embedded in well-functioning clusters. Clusters—geographic concentrations of interconnected companies, suppliers, institutions, and supporting organisations—enable localised synergies that increase efficiency, stimulate innovation, and attract talent. The primary drivers of national prosperity are not countries themselves, but the regional industry clusters that foster innovation, attract talent, and enhance productivity. As Porter argues, these geographic concentrations of interconnected firms and institutions are the true engines of economic growth.

Porter’s Diamond Model identifies four key drivers of regional competitiveness:

-

Factor conditions (skills, infrastructure, resources);

-

Demand conditions (sophisticated domestic consumers);

-

Related and supporting industries; and

-

Firm strategy, structure, and rivalry.

Government and chance act as influencing forces, shaping these interactions. In the Milan context, this framework helps explain how design schools, artisans, manufacturers, financiers, and media form a self-reinforcing ecosystem that sustains Italy’s global fashion identity. Yet it also exposes the pressures facing high-cost, high-prestige clusters in an age of sustainability and digital democratisation.

Milan’s Economic and Cultural Context

Located in the Lombardy region, which is responsible for roughly 23% of Italy’s GDP (ISTAT, 2024), Milan stands as both an economic engine and a cultural symbol. Despite Italy’s fiscal challenges and inflationary pressures (HICP peaked at 8.7% in 2022), Milan’s fashion and luxury sectors remain remarkably resilient. High-end goods continue to perform strongly, buoyed by the intrinsic value of design, brand heritage, and consumer aspiration (McKinsey & Company, 2023).

The city’s strengths lie in its advanced infrastructure, strong intellectual-property protections, and institutional excellence. Renowned schools such as Politecnico di Milano and Istituto Marangoni nurture talent pipelines for design, production, and management, while events like Milan Fashion Week anchor the city’s global visibility. At the same time, Milan’s openness to foreign investment and collaboration reinforces its position as a European creative hub (OECD, 2023).

However, the post-pandemic era has brought new vulnerabilities. A 5.3% drop in fashion exports in early 2024 highlighted the sector’s sensitivity to global shocks, while it faces mounting environmental regulations, digital disruption, and rising competition from Paris, London, and emerging Asian cities. Sustaining competitiveness thus requires moving beyond tradition toward a more integrated, inclusive, and sustainable cluster model.

Cluster Evolution: From Textile Roots to Global Luxury Hub

Milan’s fashion lineage stretches back to the Renaissance, when it was renowned for fine textiles and jewellery (Alac & Pisani, 2013). The modern cluster took shape after the 1950s, when fashion shows relocated from Florence to Milan and Vogue Italia was founded in 1964. By the 1970s, Milan pioneered ready-to-wear—a democratic yet elegant alternative to Parisian haute couture—cementing its identity as a city of practical sophistication.

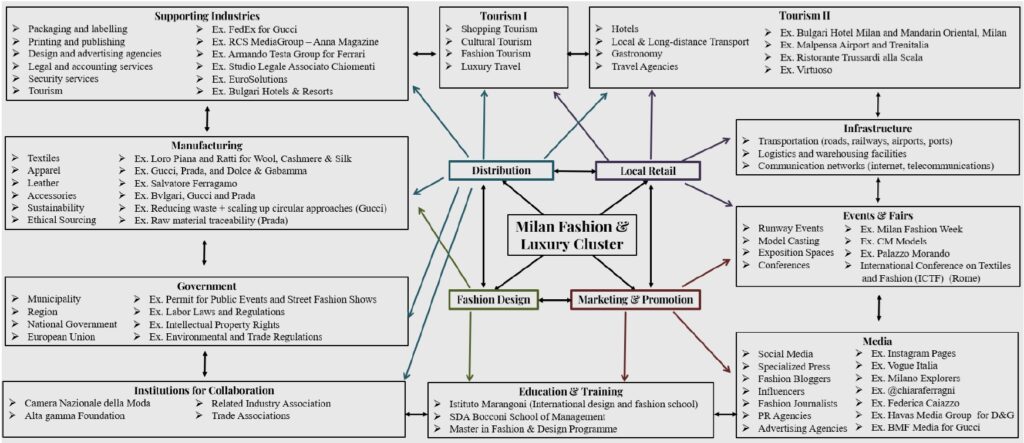

In the 1980s, the rise of Prada, Versace, Armani, and Dolce & Gabbana positioned Milan among the “Big Four” fashion capitals. Today, the cluster’s ecosystem (Figure 1) integrates four core activities—design, marketing, distribution, and retail—supported by institutions in education, finance, logistics, and media. The interplay of creativity and commerce remains at the heart of Milan’s competitive essence.

Figure 1: The Milan Fashion & Luxury Cluster Map. Source: Authors’ elaboration based on desk research.

Porter’s Diamond Model Applied to Milan

Factor Conditions

Milan benefits from exceptional human capital and institutional depth. Its design schools produce globally sought-after talent, and the region’s transport networks (Malpensa Airport, high-speed rail, and motorways) facilitate efficient global logistics. Access to luxury raw materials—from Tuscan leather to Como silk—enhances the cluster’s vertical integration.

Yet, factor disadvantages persist. High labour and real-estate costs constrain scalability, while smaller ateliers struggle to compete with multinational fashion houses. Craftsmanship, Milan’s hallmark, can paradoxically limit mass production and affordability (Patroni et al., 2012).

Demand Conditions

Italy’s domestic consumers are discerning, valuing authenticity, quality, and sustainability above all else. This demanding home market drives continuous innovation. Moreover, international tourism—from Asia, the Middle East, and the U.S.—fuels steady luxury demand through Milan’s Quadrilatero della Moda shopping district and Fashion Week.

However, the luxury market’s saturation poses risks. New generations seek more affordable, ethical, and digital fashion, challenging the exclusivity that underpins traditional luxury branding (Vogue Business, 2022).

Related and Supporting Industries

Milan’s competitive advantage lies in a dense web of related industries, including advertising, textile production, logistics, finance, and media. Vogue Italia and major agencies, such as Ogilvy Milan, provide creative visibility, while banks like Intesa Sanpaolo and UniCredit support export finance. Trade shows such as Pitti Immagine and Salone del Mobile create cross-sector synergies that reinforce Milan’s role as a global creative hub (Springer, 2019).

Nonetheless, supply-chain disruptions and high costs for premium materials expose vulnerabilities, emphasising the need for local, sustainable sourcing.

Firm Strategy, Structure, and Rivalry

Competition among iconic brands—such as Prada, Gucci, Versace, and Armani—drives constant innovation. The cluster thrives on coopetition: firms compete in design while collaborating on sustainability initiatives and policy advocacy through organisations such as the Camera Nazionale della Moda Italiana (CNMI). Digital transformation—AI design tools, virtual shows, and circular production models—is redefining strategic frontiers.

However, smaller firms face structural barriers to entry, and international competitors from France, the U.K., and Asia pose a challenge to Milan’s dominance. Maintaining leadership demands an ecosystem that nurtures both luxury heritage and new creative entrepreneurship.

Figure 2: Porter’s Diamond Model of the Milan Fashion & Luxury Cluster. Source: Authors’ elaboration based on desk research.

Key Findings and Synergies

The Milan cluster exhibits all the attributes of an advanced innovation-driven economy. Its global reach, design excellence, and substantial brand equity form the basis of sustained competitiveness. Yet the cluster’s long-term resilience depends on overcoming four critical challenges: affordability, sustainability, digital integration, and inclusivity.

1. Diversification into Accessible Luxury:

Expanding beyond the ultra-premium segment into mid-tier lines could broaden the market and stabilise revenues. Maintaining Italian craftsmanship while offering accessible quality would strengthen brand loyalty and capture new demographics.

2. Circular and Sustainable Production:

With the EU’s Green Deal tightening environmental standards, Milan’s industry must accelerate its decarbonization and circular economy initiatives. Investments in biodegradable materials, textile recycling, and carbon-neutral logistics would reinforce its leadership in responsible luxury (Deloitte, 2024).

3. Ethical and Transparent Governance:

Strengthening anti-corruption frameworks and promoting transparency across supply chains would enhance investor confidence and align with global ESG expectations. Trade associations and government agencies should establish and institutionalise certification and auditing schemes.

4. Regional and Cross-Sector Collaboration:

Milan can reinforce Italy’s cohesion by linking northern and southern clusters through shared training programs and infrastructure. Partnerships between technology firms and agricultural producers could foster fashion-tech innovation and promote the local sourcing of natural fibres (Valenti & De Luca, 2021).

Policy Lessons

The Microeconomics of Competitiveness framework emphasises that policy should enable, rather than dictate, cluster growth. In Milan’s case, this means:

-

Investing in Human Capital: Expand fashion-tech curricula and vocational training to merge creativity with digital and sustainable competencies.

-

Supporting SMEs: Provide fiscal incentives and incubation programs for emerging designers and small ateliers to counter market concentration.

-

Encouraging Sustainable Innovation: Implement targeted tax breaks for eco-certified production and research and development (R&D) in green materials.

-

Facilitating Internationalisation: Utilise trade diplomacy to enhance Italy’s fashion exports in high-growth markets, such as Asia and the Middle East.

-

Promoting Cluster Governance: Strengthening cooperation among the CNMI, regional authorities, and universities to coordinate sustainability targets and facilitate knowledge exchange.

Conclusion

Milan’s fashion and luxury goods sector remains a crucial pillar of both the local and national economy. It draws on its rich historical legacy, strategic location, and cutting-edge innovation to maintain its status as a global leader. Despite challenges such as inflation, global economic instability, and increased competition from other international fashion capitals, the city’s adaptability and resilience shine through. Milan’s deep-rooted tradition of craftsmanship, combined with a strong infrastructure and skilled workforce, supports its continued dominance in the industry. As the city addresses the complexities of modern consumer demands, sustainability concerns, and technological advancements, the fashion sector must embrace diversification and innovation. Expanding into more affordable luxury lines and accelerating sustainable practices will help secure Milan’s position in the global market while meeting the growing consumer preference for ethical fashion. Enhancing transparency and moral standards within the industry will further strengthen Milan’s worldwide reputation and attract investment. Building collaborations across different sectors and regions is essential. Milan has the potential to enhance the innovation and economic impact of its fashion cluster, encouraging greater collaboration and long-term growth. By doing so, the city can ensure its fashion and luxury goods sector remains resilient, competitive, and able to maintain its leadership in a rapidly changing market.

References

Alac, M., & Pisani, P. (2013). Fashion and Craftsmanship in Italy: Cultural Roots and Global Reach.

Deloitte. (2024). Sustainability and Digital Trends in Fashion: A Global Analysis.

ISTAT. (2024). Economic Data for Italian Regions: GDP Contributions.

McKinsey & Company. (2023). The State of Fashion 2024.

OECD. (2023). Foreign Direct Investment in Italy’s Fashion Sector.

Patroni, J., Consumano, L., Schmiedigen, P., & Secchi, M. (2012). The Fashion Design Cluster in Milan, Italy.

Springer. (2019). Creative Cities, Cultural Clusters and Local Economic Development.

Valenti, M., & De Luca, L. (2021). “Tourism and Consumer Trends in Italian Fashion.” Journal of Cultural Economics, 15(3).

Vogue Business. (2022). Can Made in Italy Survive Its Scattered Supply Chains?

*Note

This article is a summary of a comprehensive academic work developed by Rania El Ghalbzouri, Vida Asabea Ohene, Yasmine Didou, and June Bunpha under the supervision of Dr Eduardo Oliveira and Prof. Dr. Pablo Collazzo at the Business & Tourism Unit of Thomas More University of Applied Sciences, Mechelen, Belgium.

Professor Pablo Collazzo has been instrumental in introducing business schools worldwide to the MOC network and guiding them in implementing MOC classes and related research activities, including at Thomas More University of Applied Sciences. The Microeconomics of Competitiveness (MOC) course is a distinctive course platform developed at Harvard Business School by Professor Michael Porter and a team of colleagues at the Institute for Strategy and Competitiveness.

Correspondence concerning this article should be addressed to Dr Eduardo Oliveira (e-mail). The whole work is available upon request from Dr Oliveira.