By Marc Cowling (email), Oxford Brookes Business School, Oxford Brookes, Oxford, UK and Ross Brown (email), University of St Andrews Business School, University of St Andrews, St Andrews, UK

Pervasive regional inequalities permeate all layers of the UK’s socio-economic landscape, the determinants of which are in part shaped by the relative performance of the respective business populations across different regions and their ability to raise finance (Cowling et al., 2024). Innovative high-tech firms are viewed as key drivers of these regional disparities. This explains why innovative high-tech industries are frequently invoked as central components in many regional economic development strategies. One of the key constituent elements in this equation comprises business angels (BAs) who provide informal risk capital for young, innovative, technology-driven firms.

In this article, we map out the winners and losers in terms of the UK regional market place for BA finance: Cowling, M., & Brown, R. (2024). Intra- and interregional flows of business angel investment: mapping the winners and losers across UK regions and core urban economies. Regional Studies, 1–15. https://doi.org/10.1080/00343404.2024.2355990

BAs are defined as high-net-worth individuals who provide finance along with their time and expertise to help nurture nascent entrepreneurial ventures. This dual function is important and encompasses multiple roles including the provision of finance, strategic business growth assistance, relational peer support and signalling. These cashed out “habitual entrepreneurs” subsequently become investors in other start-ups, via a process known as “entrepreneurial re-cycling” are a key driver of regional economic development.

One of the key principles of angels’ investment decision making is their assumed preference for making investments in new start-up firms in close spatial proximity to their home location. It has become something of a “stylised fact” that angels have a “local bias” when selecting which firms to invest into. This occurs because it is easier to identify and assess a local investment proposition and also because it enables the angel to keep a close “eye” on their investments.

A key role angels play is to help and nurture their investee firms through proactive mentoring whilst offering vicarious learning opportunities for the entrepreneurs in charge. However, recent research suggests that this spatial heuristic in their decision making may be beginning to lessen as angels extend their spatial reach in terms of their investment decision making. Using data from the UK Business Angels Association (UKBAA) 2019 annual survey which is co-funded in partnership with the British Business Bank (BBB) we examined this issue witth an investigative study to examine the spatial logic of current business angels investments in different UK regions and core urban locations in the UK.

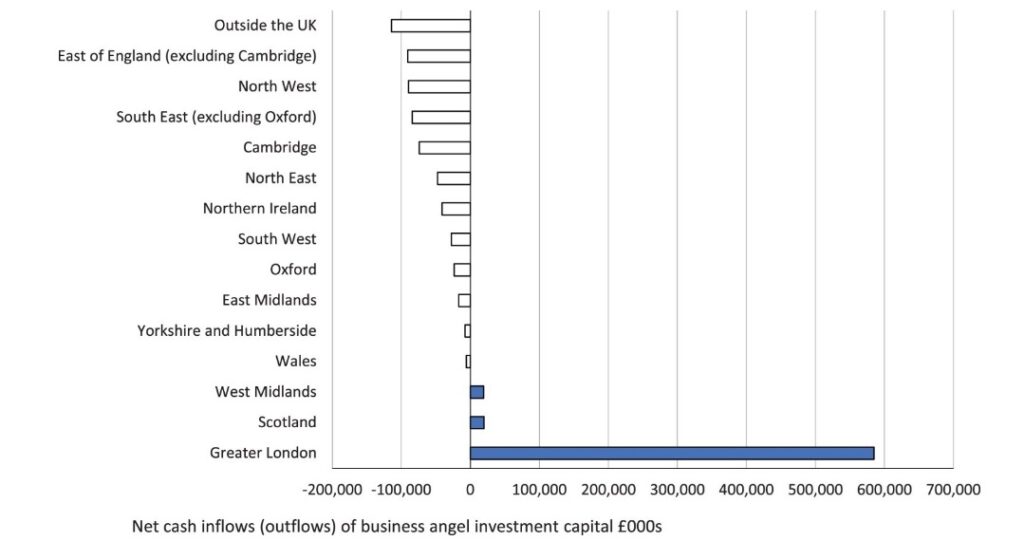

From Figure 1, we can observe that only three regions are winners (Greater London, the West Midlands and Scotland) in terms of having a positive net inflow of BA investment capital into their region and the other eleven UK regions are net losers as more angel capital flows out of their region than into it. The UK regions, however, do benefit from a net inflow of angel capital from foreign based BAs of the order of £114.4m. The three regional winners are Greater London with a net capital inflow of £584.7m, Scotland with £19.8m, and the West Midlands with £19.1m also. The biggest net losers are the North West, East of England, and South East with net outflows of £89.9m and £90.8m and £84.3m. Clearly, London is a massive outlier as the single largest and dominant net beneficiary of new capital inflows of BA investment, strongly illustrating the “dark star” thesis whereby it fundamentally dominates the UK market for entrepreneurial finance in the UK (Powell et al., 2002).

Figure 1: Net Inflows (Outflows) of Business Angel Investments Across UK Regions

Note: Calculated as home region net outflows of investment – region net inflows. Source: UKBAA–BBB Business Angel Survey, 2019. Credits: Marc Cowling & Ross Brown, 2024.

Of particular concern in terms of BA investments potentially reducing regional inequality is that the poorer regions of the UK (the North-East, Northern Ireland, Wales, and East Midlands) all had net outflows of angel investment capital of the magnitude of £48m, £41m, £6m, and £17m respectively. The fact that angel capital flowed out of these poorer regions and into wealthy regions such as Greater London would suggest that the current distribution of angel investment capital across the UK follows existing patterns of inequality and possibly will exacerbate current regional inequalities. It shows that informal risk capital is prone to the same structural spatial imbalances as formal VC.

The paper makes important contributions to theory and practice. it is clear that acute inter-regional differences in BA investment patterns are a deep-seated feature of the entrepreneurial landscape, as embodied by the “thin” versus “thick” markets thesis (Nightingale et al, 2009). The paucity and poor connectivity between start-ups and angels is probably a key determinant behind these spatial demarcations. Successful angel investors enhance the markets’ beliefs about their investing abilities (i.e. the so-called “reputation hypothesis”) and, hence, should lead to an increase in their network connectedness (Venugopal and Yerramilli, 2022). Networks act as a crucial connective tissue binding investors, entrepreneurs and regions together which can help overcome spatial separation. Indeed, some maintain extra-regional networks “can be a substitute for the benefits typically associated with regional agglomeration” by enabling firms access to non-endogenous resources “to compensate for weak local linkages” (Barzotto et al, 2019, p. 217). Therefore, a key conceptual contribution of the paper is the importance ascribed to the multi-scalar nature of entrepreneurial finance networks and how this mediates thin and thick markets. However, more work on the functioning of extra-regional networks in entrepreneurial finance is undoubtedly needed to help further unpack these issues.

From a policy perspective, given these findings the main thrust of policy approaches towards building local networks of BAs seems somewhat at odds with the diminishing local bias found herein. Stimulating the demand-side of the entrepreneurial/investment nexus, raising levels of “investor readiness” and enhancing the external connectivity of a region with more resource abundant locations appear, prima facie, more plausible policy objectives. However, given our knowledge of how investors match and interact with prospective investee ventures remains relatively sparse, these issues clearly merit further empirical scrutiny before more definitive policy recommendations can be formulated.

References

Barzotto, M., Corradini, C., Fai, F. M., Labory, S., & Tomlinson, P. R. (2019). Enhancing innovative capabilities in lagging regions: an extra-regional collaborative approach to RIS3. Cambridge Journal of Regions, Economy and Society, 12(2), 213-232.

Cowling, M., Brown, R., Liu, W., & Rocha, A. (2024). Getting left behind? The localised consequences of exclusion from the credit market for UK SMEs. Cambridge Journal of Regions, Economy and Society, 17(1), 181-200.

Nightingale, P., Murray, G., Cowling, M., Baden-Fuller, C., Mason, C., Siepel, J., … & Dannreuther, C. (2009). From funding gaps to thin markets: UK government support for early-stage venture capital. National Endowment for Science, Technology and the Arts.

Powell, W. W., Koput, K. W., Bowie, J. I., & Smith-Doerr, L. (2002). The spatial clustering of science and capital: Accounting for biotech firm-venture capital relationships. Regional Studies, 36(3), 291-305.

Venugopal, B., & Yerramilli, V. (2022). Seed-stage success and growth of angel co-investment networks. The Review of Corporate Finance Studies, 11(1), 169-210.