Emerging regional geographies of the global hydrogen rush

By Will Eadson, Professor of Urban and Regional Studies at the Centre for Regional Economic and Social Research (CRESR), where he leads a research programme on zero carbon economy and enterprise and Phil Northall, Research Associate (Sustainable Futures) at CRESR, where he researches urban and regional sustainability transitions.

This research formed part of the project “Old industrial towns at the frontier of new energy economies“, funded by the Regional Studies Association Fellowship Research Grant Scheme (FeRSA).

The potential use of hydrogen as a green fuel has rapidly grown as a policy agenda in recent years. By the end of 2021, over thirty countries had produced hydrogen strategies, and governments had committed more than $70 billion in public funding (Hydrogen Council, 2021). The 2020s have been dubbed the ‘decade of hydrogen’ (Gill, 2020).

In many countries, hydrogen and related industrial decarbonisation strategies have taken a strikingly regional character, with distinctive hydrogen geographies beginning to emerge. This raises important questions around the variable implications for regions of emergent hydrogen economies: how and why are particular ‘hotspots’ emerging? What are the logics of development in different regions? What are the social, economic and environmental implications for those regions? And what about the regions which are not included in initial plans?

But first, it is worth briefly setting the scene: what is hydrogen? How is it produced? How can it be deployed to support decarbonisation goals?

The extent to which hydrogen can support decarbonisation depends on the method used to produce it. These range from the lowest carbon ‘green hydrogen’, produced using renewable energy, to ‘black’ or ‘brown hydrogen’, which requires fossil fuel combustion. The current most common and cheapest method is ‘grey hydrogen’, created from natural gas reformation, whilst an increasingly popular route in hydrogen investment plans, ‘blue hydrogen’, adds Carbon Capture, Utilisation and Storage (CCUS) technology to this process to reduce CO2 emissions.

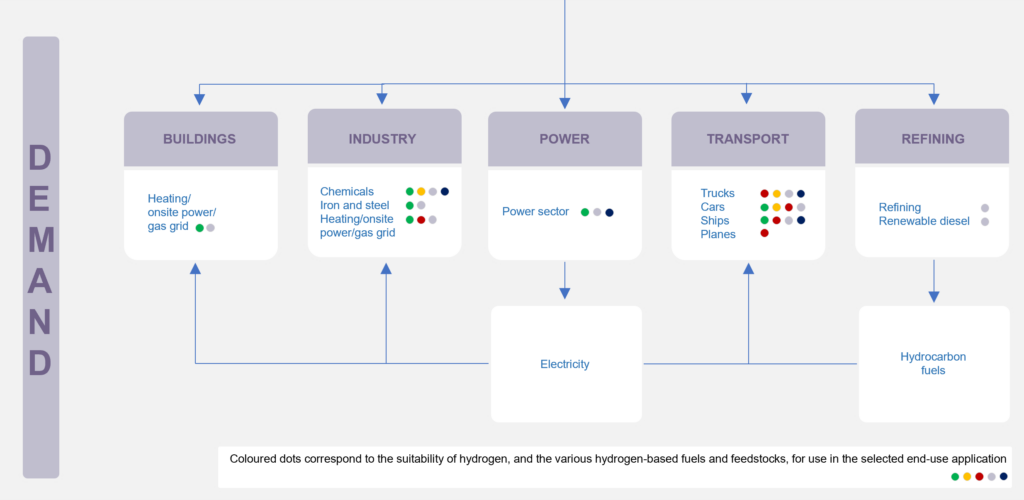

Current hydrogen use is largely limited to oil refining and chemical production but it has been promoted by the IEA (2019) and in national strategies (BEIS, 2021) to decarbonise heavy industries, transport, building heating, and power generation (Figure 1). The suitability of hydrogen in these domains is highly variable and its wholesale promotion betrays the “chicken and egg problem” (BEIS, 2021: 10) or the need to stimulate both supply and demand in this nascent economy.

Figure 1: The demand side of the hydrogen value change

Source: International Energy Agency (2019: 29)

Our empirical research focused on 5 regional clusters in Northern Europe: Humber Industrial Cluster Plan in the Humber region of England; Hynet in the North West of England; ACORN and NECCUS in north and east Scotland; HEAVENN and Europe’s Hydrogen Hub in the Netherlands; and Hybrit in northern Sweden.

What we found

Over €38bn has been invested in 38 ‘hydrogen valleys’ across 20 countries (as identified on the Hydrogen Valley Platform, November 2022). Investment geographies have been driven by various material, infrastructure and industrial location factors. For instance, the Humber is referred to as a ‘super region’ due to its considerably higher emissions compared to the other industrial clusters in the UK; proximity to existing gas storage facilities, as well as natural geological storage sites; presence of renewable energy sources, primarily offshore wind; high concentration of potential end users, including energy generators, steel producers, and oil and chemical producers; and its existing skills and infrastructure, based on the oil and gas industries.

While there was variation between projects, a common theme – particularly in England and Scotland – was private sector partnerships taking the lead in regional hydrogen development plans. Local and regional governance institutions played a supporting role, facilitating planning and promoting opportunities. Gas and oil companies were at the forefront in the Netherlands, England and Scotland, particularly around efforts to promote ‘blue’ hydrogen as a transition fuel. This level of partnership working was seen as rare and is a distinctive form of ‘business-orchestrated regionalism’ (see Harrison, 2021).

Investment logics focused on business risks of inaction and the potential for new economic benefits through innovation and increased inward investment. For gas and oil companies, hydrogen and related CCUS deployment created an opportunity to diversify markets while maintaining the use of potentially ‘stranded’ assets in the form of oil and gas pipelines and infrastructure. CCUS from blue hydrogen production and other industrial emissions also created opportunities to use previously redundant infrastructure for gas storage. Regional development policy-makers saw opportunities for jobs and environmental gains of CO2 reductions.

Our research participants also highlighted a range of risks relating to these investments. We summarise six of these as follows:

- Reliance on blue hydrogen. Plans in the UK and Netherlands rely on blue hydrogen as the medium-term technical solution. This is dependent on continuing gas supplies and effective CCUS measures. The cost implications of continuing reliance on gas are potentially challenging, although the UK and Netherlands have their own gas sources. But even without the recent spike in prices, research participants felt that hydrogen production and utilisation will only be feasible with sufficient subsidies from national government.

- Precarious industrial economies. Hydrogen and related CCUS projects are not a silver bullet to hold down energy-intensive industries. Many respondents saw potential competitive advantages linked to these developments. Still, some research participants said that these technological advancements would not resolve competitive pressures in global markets, and business models for energy-intensive industries in older industrial regions would remain precarious.

- Public engagement and acceptance. Many of our research participants thought there would be intense public acceptance of hydrogen and CCUS infrastructure because they were located in areas with long histories of industrial development. However, actual engagement with the local public was limited, risking a democratic deficit in decision-making. One potential risk is that outcomes focus more on maintaining industrial development than benefiting local people.

- Reliance on trickle-down job creation. Related to (3) the investment logics for places focused on job safeguarding and creation through infrastructure investments, potential technology spillovers and/or local supply chain opportunities. The primary investments were made through large multinational companies who it was hoped would then drive further investment and job creation. The risk from a regional development perspective is that these benefits do not support local communities in regions with high levels of deprivation due to previous rounds of economic restructuring.

- ‘Regret options’. Regional strategies often focus on a wide range of potential uses for hydrogen. It is unlikely that all of these will be economically viable or the most efficient means of decarbonising individual sectors. The rationale was to stimulate demand and supply side markets: attempting to deal with the ‘chicken and egg’ problem of stimulating growth in emerging technology.

- Selective hydrogen geographies. At present, hydrogen developments are coalescing around resource and infrastructural hotspots, which have also successfully built coalitions to capture government funding. These have a clear geographic pattern, concentrated in coastal industrial regions. Industrial clusters away from these sites face challenges to build hydrogen and CCUS infrastructure, requiring different solutions which still need to be more clearly addressed by government or private sector investment.

References

The Department for Business, Energy, and Industrial Strategy=BEIS (2021) UK Hydrogen Strategy. UK: Department of Business, Energy and Industrial Strategy.

The UK’s Department for International Trade=DIT (2022) Hydrogen Investor Roadmap: Leading the Way to Net Zero. UK: Department for International Trade.

Harrison, J (2021) Seeing like a business: rethinking the role of business in regional development, planning and governance. Territory, Politics, Governance, 9(4): 592-612.

International Energy Agency=IEA (2019) The Future of Hydrogen: Seizing today’s opportunities – Report prepared by the IEA for the G20, Japan. International Energy Agency.

The UK Energy Research Centre=UKERC (2022) The role of local action in addressing industrial emissions. UK Energy Research Centre.

UK Research and Innovation=UKRI (2021) UKRI awards £171m in UK decarbonisation to nine projects. UK Research & Innovation.