Firms responding to the shortage of essential COVID-19 products: readings from economic geography

By Simón Sánchez-Moral and Alfonso Arellano, Complutense University of Madrid and David Martinez-Turegano, European Commission

This research formed part of the project “Disentangling COVID-19 as a driving force of path development processes in Spain“, financed by the Regional Studies Association Membership Research Grant Scheme (MeRSA).

The outbreak of the COVID-19 pandemic created a scenario that would have been unimaginable only a few weeks previously. Difficulties in purchasing abroad and interrupted supply chains against a backdrop of significant demand shock triggered a medical equipment supply shortage, especially during the initial moments of the pandemic. This shortfall was particularly severe in countries strongly reliant on international trade, such as Spain (García Esteban et al., 2020). Urged to act quickly, national and international institutions and governments started to list essential COVID-19 products as a first step to ensure this supply to the population. In addition, they launched various measures to regulate international trade in these products, coordinate the delivery of medical equipment, increase domestic production capacity and accelerate medical product certification.

At the same time, press and consultancy reports began to document a rising number of firms reorienting their production in response to the urgent demand for these products worldwide — Mecha López (2021) has compiled examples of these in Spain. Some of the most notable examples included large multinationals in the automobile sector, which began to manufacture respirators for hospitals, and medium-sized companies from industries that were, in principle, as technologically distant as the manufacture of thermal infrared cameras or 3D printing. Meanwhile, cosmetics and sun-cream firms adapted their manufacturing lines to produce a hydroalcoholic gel, and sportswear companies began to manufacture face masks, gowns or gloves. Even aeronautical components manufacturers launched the protection visors for PPE (personal protection equipment).

Identifying some initial research issues

The medical equipment supply shortage problem has attracted research attention in several disciplines (e.g. Livingston et al., 2020; Cohen and Rodgers, 2020; Ho et al., 2022), including economic geography (e.g. Bailey et al., 2020; Harris et al., 2020; Méndez, 2021; Sedita et al., 2022). In this context, the responses of those firms can be interpreted in particular from the point of view of the evolutionary economic geography (Boschma, 2017; Hassink et al., 2019). On the one hand, having witnessed the transfer of industrial capacities to the region of Asia over the last decades of globalisation and a corresponding increased dependence on international supply chains, to the detriment, for example, of the United States and Europe, some firms will have perceived the opportunity presented by supplying local markets during the pandemic —beyond their desire to help out in such a significant crisis. Indeed, in Spain at least, a general expectation became apparent —whether realistic or not— of achieving a level of re-industrialisation in some regions thanks to the situation. But, on the other hand, it also seems reasonable to assume that some firms probably thought that similarities in knowledge and technology between their activities and those involved in the manufacture of COVID-19 products would make it easier for them to move into these new areas, diversifying their production or even creating new firms based on prior experience.

Addressing these issues is far beyond the scope of this article. Instead, we propose an exploratory analysis of business dynamics and strategies within the manufacture of medical and dental instruments and supplies in Spain. These supplies include COVID-19 products such as catheters, syringes, protective goggles and respirators, paying particular attention to new firm creation and diversifiers as a critical mechanism for regional diversification. The rationale for this selection is twofold. On the one hand, there are several lists of essential COVID-19 products, including the one drawn up by the World Customs Organization (2020), based on the HS classification of goods traded internationally, which served as the basis for the Eurostat reference list (2021). On the other hand, given our interest in firms manufacturing these medical products, we opted to use the more common NACE (code: 325) international industrial classification (Leibovici and Santacreu, 2020). On the other hand, this selection would enable us to connect the few available statistics with sufficient temporal, sectoral and territorial coverage to conduct this pilot study.

The diversification response: why, how and where?

Notwithstanding data limitations, our future goal is to integrate better the different approaches deployed in this exploratory analysis. With this in mind, we present some of our most relevant results below:

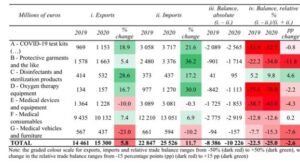

First, an analysis of Eurostat data confirmed Spain’s deficit concerning the rest of the world, measured as a proportion of import and export balance on these products over the sum of both, estimated at more than €10bn in 2020. This deficit affected almost all product categories, including ‘Test kits/ Instruments and apparatus used in diagnostic testing’, ‘Protective garments and the like’, ‘Oxygen therapy equipment’, ‘Medical devices and equipment’, ‘Medical consumables’ and ‘Medical vehicles and furniture’, the sole exception being ‘Disinfectants and sterilisation products’ (Figure 1). Although the indicator does not account for domestic production capacity, the observed external trade dependence suggests the existence of a market opportunity (why).

Figure 1: Exports and imports of COVID-19-related products for Spain. Source: Adapted from Sánchez-Moral et al. (2021).

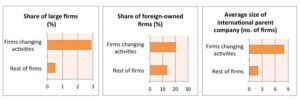

Second, an exploratory analysis of the ORBIS database (Bureau van Dijk) confirmed that about 190 firms had started activity within the medical and dental equipment and supplies sector since January 2020. This means that the birth rate of firms in 2020-2021 was clearly above that of the economy as a whole (7.60 as against 3.72 per 100 existing firms). Simultaneously, 143 firms reported a change in activity over the same period. According to the National Statistical Institute, the majority of active firms in this sector in 2020 had no employees or only 1 or 2, suggesting a significant number of non-manufacturing firms that import and trade these products. It is vital to bear this when interpreting the figures presented here, which were refined using the firms’ main activity as the criterion for their selection. Furthermore, initial results based on Bonferroni tests indicate that these firms tend to be larger than other firms, attract more foreign capital and belong to larger international groups, suggesting the importance of access to external knowledge sources (Figure 2). In summary, new entries and diversification strategies form part of the sector’s response (how); furthermore, according to a survey conducted by the Spanish Federation of Healthcare Technology Companies (FENIN, 2021), the pandemic also served as a stimulus for research and development.

Figure 2: Characteristics of firms in the medical equipment and supplies sector. Source: Based on ORBIS (Bureau van Dijk).

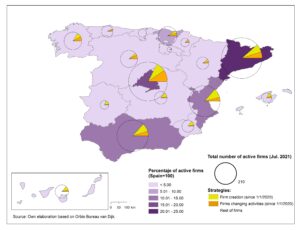

Third, the spatial distribution of active firms across Spanish regions shows a clear bias towards Cataluña and Madrid, which account for almost 40% of them, followed by Valencia and Andalusia (Figure 3). An examination of firms’ strategies confirmed that in some regions (e.g., Extremadura, Islas Baleares, Murcia), the creation rate during the pandemic was above the national average. In contrast, other regions (e.g., Madrid, Galicia, Navarra) displayed a higher relative presence of firms changing their activity.

Figure 3: Regional impact of firms’ strategies within the medical and dental equipment and supplies sector

These outcomes resulted from a combination of different forces (where). The emergence of urbanisation economies in the two largest cities in the country, Madrid —the most over-represented region in terms of the presence of firms changing their activities— and Barcelona, is unsurprising given the fact of activities related and unrelated to medical equipment and supplies sector, as well as all sorts of urban infrastructures, facilities and affiliated institutions, particularly in the research and education sector. Likewise, some regions, such as Barcelona and the Basque Country, already had a prior tradition of medical product manufacturing. Noticeably, in other cases, the high incidence of new firms or firms changing their activities seems to have coincided with the existence of related industries, as in the case for example of the medical textile industry clustered in some parts of Valencia —the most over-represented regions in terms of new firms created within the sector. In short, this initial evidence suggests a combined influence of location economies and probably technological relatedness.

Some lessons to guide further research

The supply shortage of essential COVID-19 products and external trade dependence may have triggered the pandemic’s beginning, stimulating the creation and diversification strategies. Our exploratory analysis of the medical equipment and supplies sector suggests that the success of these strategies may be connected to benefits for firms located in dense and more diversified urban areas or for firms participating in collaboration and innovation networks with peers and institutions. Moreover, despite the artificial sectoral boundaries drawn for this pilot study, the influence of relatedness connecting medical product manufacturing with other manufacturing sectors is notable. Future research could employ more sophisticated quantitative tools to measure these forces and adopt a qualitative approach to firms and other actors.

Acknowledgements

The authors would like to thank Professor Mario Vale (University of Lisbon) for his valuable comments on drafts of this manuscript. The usual disclaimers apply.

References

Bailey, D., Clark, J., Colombelli, A., Corradini, C., De Propris, L., Derudder, B., Fratesi, U., Fritsch, M., Harrison, J., Hatfield, M., Kemeny, T., Kogler, D.F., Lagendijk, A., Lawton, P., Ortega- Argilés, R., Iglesias Otero, C. and Usai, S. (2020). Regions in a time of pandemic, Regional Studies, 54 (9), 1163-1174.

Boschma, R. (2017). Relatedness as driver of regional diversification: a research agenda, Regional Studies, 51(3), 351-364.

Cohen, Y. and Rodgers, Van der M. (2020). Contributing factors to personal protective equipment shortages during the COVID-19 pandemic, Preventive Medicine, 141.

Eurostat (2021). HS/CN8 classification reference list for dataset’ EU trade since 2015 of COVID-19 medical supplies

García Esteban, C., Martín Machuca, C., and Viani, F. (2020).El comercio internacional de productos médicos durante la pandemia de Covid-19, Boletín Económico del Banco de España, 4, 24-27.

Harris, J., Sunley, P., Evenhuis, E., Martin, R., Pike, A. and Harris, R. (2020). The Covid-19 crisis and manufacturing: How should national and local industrial strategies respond? Local Economy, 35(4), 403-415

Hassink, R., Isaksen. A., and Trippl, M. (2019). Towards a comprehensive understanding of new regional industrial path development, Regional Studies, 53(11), 1636-1645.

Ho, W., Maghazei, O., and Netland, T.H. (2022). Understanding manufacturing repurposing: a multiple-case study of ad hoc healthcare product production during COVID-19. Oper Manag Res. https://doi.org/10.1007/s12063-022-00297-1.

Leibovici, F., and Santacreu, A. M. (2020). International trade of essential goods during a pandemic, Federal Reserve Bank of St. Louis, Working Paper No. 2020-010.

Livingston, E., Desai, A. and Berkwits, M. (2020). Sourcing Personal Protective Equipment During the COVID-19 Pandemic, JAMA, 323(19), 1912–1914.

Mecha López, R. (2021). Los sistemas productivos locales españoles ante la pandemia “glocal” de la COVID-19: Ejemplo de rápida reconversión en ciertos sectores. In B. Puebla Martínez and R. Vinader Segura, Ecosistema de una pandemia: COVID 19, la transformación mundial. Dykinson.

Méndez, R. (2021). Sitiados por la pandemia. Del colapso a la reconstrucción: una geografía. REVIVES.

Sánchez-Moral. S., Arellano, A. and Martínez-Turegano, D. (2021). Regional diversification strategies in the medical equipment and supplies sector during the COVID-19 pandemic: an approach to contextual factors, International Conference on Regional Science (AECR-Spanish Association of Regional Science).

Sedita, S.R., Blasi, S. and Ganzaroli, A. (2022).Exaptive innovation in constraint-based environments: lessons from COVID-19 crisis, European Journal of Innovation Management, 25(6), 549-566.

WCO, World Customs Organization (2020). HS classification reference for Covid-19 medical supplies, 3.01 Edition.