The role of financial institutions in climate change mitigation in rural areas with evidence from Tajikistan

DOI reference: 10.1080/13673882.2022.00001004

By Takhmina Akhmedova, Master Student of the Master in Sustainability, Society and the Environment at Christian-Albrechts-Universität zu Kiel, Germany

Much of the debate on climate change adaptation has focused on the various aspects of funding for adaptation and mitigation activities. The 2021 United Nations Climate Change Conference (COP 26) recognized the importance of climate finance and emphasized the need to scale up funding. Although there has been little or no attention paid so far to how these resources would be channelled to the sub-national level, especially to target the poor who are frequently the most vulnerable to climate change (IETA COP26 SUMMARY REPORT). The article describes how inclusive, microfinance solutions enable vulnerable communities to build resilience by creating income-producing activities, building up assets, and promoting the transition to sustainable futures. This is done by reflecting on rural areas and microfinance in Tajikistan with a focus on the CLIMADAPT project experience (FAO, 2018; Dasgupta, et al. 2014).

Microfinance has been recognized as an important tool to fight against poverty and in the recent decades, there have been studies in the microfinance and climate change science, grounded in the belief that combining these tools can bring transformational change (Hammill et al., 2008; Agrawala and Maëlis, 2010). Rippey (2012) notes the important role of Microfinance Institutions in advocacy and policy debate. As an important tool for the financial inclusion of the low-income population, microfinance institutions can play a significant role in raising climate change awareness, contributing their voices to those who are calling for prompt, effective action (Cord et al. 2008). Microfinance Institutions can also represent their clients’ interests in policy debates making sure that their voices are heard.

Country context

Tajikistan is a landlocked country located in southeast Central Asia. Mountains occupy about 93% of the terrain and glaciers make up 6% of the total country area. Agriculture is the largest sector of the economy of Tajikistan, which accounts for 20% of the country’s GDP and 53% of domestic employment (WB, 2021). Changing climate has already been negatively affecting the economy, society, and ecosystems of the country, including faster erosion of forest soil from extreme weather events, deteriorating water quality from melting glaciers, and loss of biodiversity. Predominant dependence on climate-sensitive sectors makes the country highly vulnerable to climate change and extreme weather events.

Tajik Microfinance Institutions (MFIs) in climate action

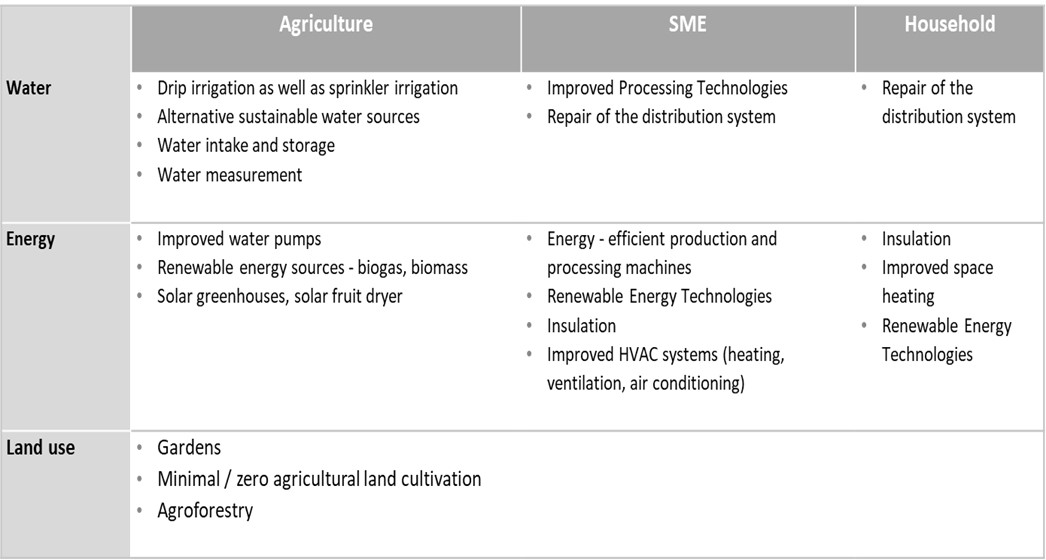

The Tajik Climate Resilience Financing Facility (EBRD, 2015) is supported by the European Bank for Reconstruction and Development (EBRD) and Climate Investment Funds and is specifically dedicated to investments in improved climate resilience technologies to help make the Tajik private sector more resilient to climate change. CLIMADAPT is an intermediated finance facility that started by on-lending to local banks through the creation of concessional finance facilities and conditions for loans to end beneficiaries (CIF, 2018). The CLIMADAPT credit line operates through Tajik banks and microfinance institutions for on-lending to final or end-beneficiaries at a lower interest rate (22-23%): households, Micro-, Small and Medium-sized Enterprises (MSMEs), farmers, and communities (Table 1).

Table 1. Overview of activities

Tajikistan has been benefitting from the Pilot Program for Climate Resilience supported by the climate investment fund since 2009. An example of intermediary financing through the European Bank for Reconstruction and Development supported CLIMADAPT project showcases how microfinance institutions, through service conditions that incentivize sustainable resource stewardship, may reinforce longer-term vulnerability reduction gains. Local Microfinance Institutions (MFIs) offered more loans at lower interest rates to farmers, SMEs, and households who were interested to undertake sustainable soil and water management practices. With a focus on economic, social, and environmental returns, MFIs make a valuable contribution to vulnerability reduction and climate adaptation in developing countries. CLIMADAPT financial facility and microfinance institutions take climate action in three ways, particularly:

Summary of CLIMADAPT interventions

Intermediating climate funding

- Serve as an intermediary between local banks, MFIs, NGOs, end-users, and climate funds as well as articulating the needs of the local financial institutions and clients.

Distribution of green technologies

- A list of prechecked, qualified green technologies and technology providers, with descriptions and instructions, is made available for MFI clients.

- Climate resilience assessment of potential investments and consultation on a solution.

Awareness-raising

- Building capacity of local banks, MFIs, NGOs, and clients on climate change issues.

- Support of MFIs in the development and implementation of climate risk mitigation strategies.

- Technical advice is provided to support the adoption of technologies and practices that reduce soil erosion and pressure on water and energy resources.

Conclusion

The consequences of climate change will greatly increase the vulnerability of poorer, marginal households in low- and middle-income countries. For most the communities in rural areas, ecosystem services play a crucial role in their survival and hopes of prosperity. The degradation of the environment put great stress on inputs used by microfinance clients—livestock, water, land—and thus on their ability to repay loans, risking their profitability and financial sustainability. As a result, climate change will impact microfinance institutions both directly and indirectly. When it comes to building climate resilience, insights from the literature and the case study show that microfinance can be an important tool. This case demonstrates that intermediated microfinance can help transform financial services both in terms of products and services, as well as market penetration processes, to foster business development and build resilience across industries. By incentivizing sustainable resource management, green microfinance can reinforce longer-term reductions in vulnerability. However, access to green technology can not be a single solution. Therefore, there is a need for closer cooperation with local authorities and clients for a better needs assessment. Analysis of the case shows that MFIs in Tajikistan have yet a limited-service area focused on the client level only. However, the literature review describes institutional and system-level interventions (Rippey, 2012) that would be important for the mitigation of climate risks in the financial sector (Pantoja, 2002). Working with multilateral institutions and donors MFIs can develop concessional funding facilities for dealing with catastrophes, offering crop, health, livestock, and disaster risk insurances.

References

Agrawala, S. and Maëlis, C. (org). (2010). Assessing the role of microfinance in fostering adaptation to climate change. Paris, OECD Environmental Working Paper No. 15, OECD.

CIF=Climate Investment Funds (2018). Apples, adaptation, and agriculture. The CIF in Tajikistan, Climate Investment Funds.

WB=The World Bank Group and the Asian Development Bank. (2021). Climate Risk Country Profile: Tajikistan

Cord L., Hennet C., and G. van der Vink, (2008). Climate Change and Poverty: Towards an Integrated Policy Framework for Adaptation. PREM Economics of Climate Change Discussion Papers, World Bank, Washington DC.

COP26-Summary-Report. (2021).

Dasgupta, P., J.F. Morton, D. Dodman, B. Karapinar, F. Meza, M.G. Rivera-Ferre, A. Toure Sarr, and K.E. Vincent, (2014) Rural areas. In: Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects. Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA, pp. 613-657.

Dowla, A. (2018). Climate change and microfinance. Business Strategy & Development, 1:2, 78-87.

EBRD=European Bank of Reconstruction and Development. (2015) Tajik Climate Resilience Financing Facility.

FAO=Food and Agriculture Organization (2018) Guidelines on defining rural areas and compiling indicators for development policy.

Hammill, A., Matthew, R. and McCarter, E. (2008). Microfinance and Climate Change Adaptation. Institute of Development Studies Bulletin 39(4): 113-122

Introduction to Climate Finance | UNFCCC

National Climate change adaptation strategy of Tajikistan for 2020-2030 (2019)

OECD=Organization for Economic Co-operation and Development. (2016). Tajikistan Financing Climate Action.

Pantoja, E. (2002). Microfinance and Disaster Risk Management: Experiences and Lessons Learned. The World Bank: Washington, WA, USA.

Rippey, P. (2012). Microfinance and climate change: threats and opportunities. in: Greening the Financial Sector. Springer Berlin Heidelberg, p. 215-239, 2012.

UNEP=United Nations Environment Programme. Financial Institutions Taking Action on Climate Change.