Comparing financialisation of urban development in Chinese coastal and inland cities

DOI reference: 10.1080/13673882.2020.00001076

By Zhuoya Kang (email)

Financialisation is currently being rethought beyond the economics and finance fields. In urban planning discipline, financialisation is more often defined as a process which engages increasing dominant roles of financial actors, financial markets and financial practices that lead to a structural transformation of economic entities (Aalbers, 2019). From the 1980s, various financial tools were implemented into urban redevelopment, which demonstrably has borne fruit in many cases, such as Tax Increment Financing in Chicago (see Weber, 2010), Special Purpose Vehicles in Milan (see Savini & Aalbers, 2016) and Private Finance Initiative in London (see Christophers, 2017). Following the enactment of opening policy, China entered in a reform era that has significantly promoted the market economy.

Alongside with plentiful new policies coming out, financial roles like Local Government Financial Platforms (LGFP) act as a bridge connecting finance markets and government sectors that nourishes the different urban projects. However, rather than complementing country-level comparison, the renewed interests shed light on how different cities in different regions are financialised. More particularly, when facing new challenges for urban growth, such as inner-city shrinking, urban congestion, and unbalanced resources distribution, new towns are often employed as a way to pursue development. New towns function as a ‘spatial fix’ for accumulating capital in multiple fields, while state intervention takes an active role in securing its development by sophisticatedly manipulating market operations (Shen & Wu, 2017). Hence, two new town cases are selected for inter-urban comparisons to reveal how local geographies are being shaped by financialisation and how regional geographies affect the financing process.

The first case, Binjiang new town, is located in Hanzhong, Shaanxi province. Under the pressure of being lagged for development, a new town proposal was formed one decade ago. Relying on the pleasing natural views, local governments decided that this area was to be mainly a residential district with well-designed greenways adjacent to the Han river. Public infrastructures including school, hospital, and other amenities were planned within a 53 km2 footprint. As the headstream of South-to-North Water Division, heavy industries were not permitted in Hanzhong; hence, currently developed land (about 10.2 km2, north of the river) are, besides living areas, offices, leisure, and cultural zones (see the Binjiang official website).

Figure 1. Binjiang new town. Source: Zhuoya Kang, 2020

Figure 2. Binjiang new town. Source: Zhuoya Kang, 2020

Another case, Zhenhai new town, locates in Ningbo, Zhejiang province. A total of 46 km2 is characterised by business, administrative and culture centres of Northern Ningbo, with a large number of residential buildings, service infrastructure and amenities. Surrounded by neighbouring secondary and tertiary industries, Zhenhai became a new gateway, opening for logistics, commercials and finances (see Zhenhai official website).

Figure 3. Zhenhai new town. Source: Zhuoya Kang, 2020

Figure 4. Zhenhai new town. Source: Zhuoya Kang, 2020

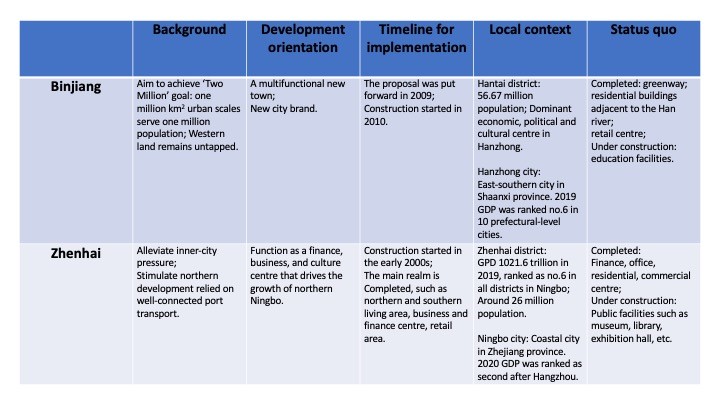

Although the new town is widely proposed for solving urban problems, obviously the socio-economic conditions of selected cases are quite distinct (see Table 1). As a comparison, the administrative district-level GDP, Zhenhai is twice as large as Hantai. The contrast between the economic capabilities of each region is even higher. Thus, the speed and intensity of development are quite distinct, which reflects the preferences of investments and growth of the financial markets.

Table 1. Comparative information on the new towns. Source: Author’s own elaboration

In Hantai, the main engine for growth relies on property development. Major developers in China, such as Evergrande Group and Country Garden, came to the inland city to meet their annual investment targets, since the property market is only just emerging in these cities. The financial tools for feeding new towns predominately rely on land prices. LGFP used land mortgages to fill the finance gap for roads and bridges, and issued city development bonds as a supplement. Since the local government lacks a budget, the way of commencing the project is using ‘priorities’ (often the development rights) given to potential developers who are willing to take responsibility for infrastructure parts (evidence from interviews taken in 2020). Alongside the land arrangements, land prices have increased simultaneously, which generates considerable land conveyance fees and land tax for local government. Progressively, Binjiang became an incubation centre for different projects that bring in loans and capital, supported by the upper-level government and as a result, it has been experiencing surging of property investment, captured by decent apartments and retail centre.

Due to the relocation of the district government, altitude towards the future of Zhenhai is quite positive. The investment has accumulated above 100 billion RMB so far for infrastructure. Supported by robust local industries basis, Zhenhai takes the role of a service centre embracing the financial, commercial and cultural functions. Besides the common ways for financing new town as Binjiang, Zhenhai engages more private sectors for engineering projects through Build-Operate-Transfer process. Additionally, owing to the local culture, the first group of people being rich (called Ningbo Bang in Chinese) is willing back to contribute to their hometown’s development. Thus, facilities for public welfare were built extensively, such as parks, museums, exhibitions. Moreover, other ways like trust financing, finance lease, are also adopted for public infrastructure projects (Zhenhai Government, 2020).

The operation of the new town began with the establishment of a committee that manipulates the investment. Committees perform at one hand as a governmental branch that handles the executive affairs; and on the other hand, as an active participant in the market economy. Although both new towns have no independent administrative rights, committees are the official representors for decision making and take the role of supervisors. In contrast with Zhenhai, the Binjiang committee is on the way to transforming itself into an enterprise that is entirely a private developer. The notion of ‘collectivise management’ was brought up since 2018, so that the managing of the new town will follow these standards and the time for activating projects should dramatically decrease. Since the land arrangement, relocation and resettlement of residents have been completed, the Committee seeks to be self-financing via profitable investments, such as creating investment companies and education brands. However, such a transformation is not as easy as it seems; a government background is more beneficial for cooperation with banks and acquiring financial assistance. Thus, it is essential to stimulate the reform of policies and regulations that are preconditions for altering into an ultimate private corporation that could finance new town via more market-oriented tools.

Final remarks

To conclude, this article compares the inland and coastal city of financialisation based on the new town projects. There is no doubt that government’s intervention drives the characters of financialisation in China. In different regions, the local context and policies preferences will deliver different ways for project financing and developments. For instance, Zhenhai is more open to the private sector, while Binjiang depends on more their committee. However, with more burden and constraints under the role of government, the Binjiang committee is keen to reform as a developer since this way of financing could be more effective and innovative. New towns are a complex milieu of differing micro-economies, state regulations and political configurations, and the outcomes on the ground are being shaped by multiple roles and stakeholders who raise the capital flow in different economic sectors.

Although in terms of urban landscape, living environment and amenities, new towns shape well-lived experiences. Financialisation of new towns in different regions still demonstrates the vital role of land in the whole process of moving capitals. Hence, the prominent risks remain such as the fluctuation of land markets, the uncertainty of debt-triggered growth, alongside with the situation of population outflow. Furthermore, a set of questions remain: how to generate sustainable development for new town futures? How can different regions learn from each other for tailoring suitable financing models? How can the local maximise the impact of capital on the built environment at the same time as embracing differentiated growth? If we want to explore the financialisation of cities, comparation case studies are one useful tool in this agenda.

References

Aalbers, M. B. (2019). Financial geography III: The financialization of the city. Progress in Human Geography, 0309132519853922.

Binjiang New Area (2020). Available from: http://bjxq.hanzhong.gov.cn/

Christophers, B. (2017). The State and Financialization of Public Land in the United Kingdom. Antipode, 49(1), 62–85.

Ningbo Zhenhai New Town (2020). Available from: http://www.zh.gov.cn/art/2019/4/24/art_1229054210_36.html

Savini, F., & Aalbers, M. B. (2016). The de-contextualisation of land use planning through financialisation: Urban redevelopment in Milan. European Urban and Regional Studies, 23(4), 878–894.

Shen, J., & Wu, F. (2017). The Suburb as a Space of Capital Accumulation: The Development of New Towns in Shanghai, China. Antipode, 49(3), 761–780.

Weber, R. (2010).Selling City Futures: The Financialization of Urban Redevelopment Policy. Economic Geography, 86(3), 251.

Zhenhai government (2020). Available from: http://www.zh.gov.cn/col/col1229034607/index.html

About the author

Zhuoya Kang is a PhD student working in the faculty of architecture, building and planning, The University of Melbourne. Before that, she acquired a Master Degree in International Planning at the University College London and a Bachelor Degree in Urban Planning and Design at the University of Liverpool. She also worked in urban planning institute and company in Beijing and Shanghai. Her research interests are about urban economics, urban governance, new town planning, planning in China, UK and Australia. Contact information.