Brexit and the media industry – How Europe’s capitals attract UK’s businesses

DOI reference: 10.1080/13673882.2018.00001051

By Marlen Komorowski, Cardiff University, UK.

The UK referendum in June 2016 surprised many and the main concern since then has been the uncertain outcomes of the Brexit negotiations. After three years, not much has changed about these uncertainties on a political level, but businesses and Europe’s cities have taken action, and much has happened outside the political sphere. London-based businesses have looked for or have found new European ground outside of the UK and governments from all levels have implemented strategies to attract these businesses into their cities. At the forefront of concerns is London’s financial sector. What many people tend to forget however, is that London is not only the European financial capital but also the European media capital. Brexit has already influenced London’s media industry and some (but not all) major European cities will benefit from that. This article by Marlen Komorowski, researcher at imec-SMIT-VUB and impact analyst at Cardiff University, takes a look at a number of press articles published on the topic since summer 2016 and highlights the impact of Brexit on the media industry.

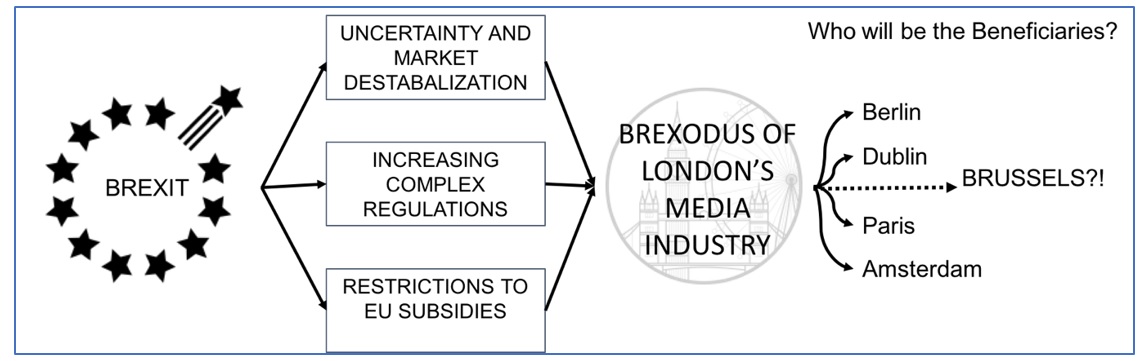

The Impact of Brexit on London’s media industry

London is widely considered the media capital of Europe (Hoyler and Watson, 2012). In academic literature, it is described as an internationally recognized media cluster that agglomerates in neighbourhoods like Soho or the Silicon Roundabout in East London with significant concentrations of media activities (Komorowski, 2017). London’s government estimates that the creative media industries as a whole comprise of 4100 companies, which employ around 142000 people in and around London. More importantly, London brings together well-known and internationally acting media firms. This includes a whole host of radio stations and internationally distributed newspapers. American new media companies like Facebook and Google have huge offices in London. London also hosts major broadcasters, including the BBC (the world’s largest broadcaster by number of employees), CNN International, ITV, BskyB, Channel 4 and Five (London’s Economic Plan, 2017). Discovery Communications Inc. transmits more than 120 television feeds into Europe from London (including Animal Planet and Eurosport); Walt Disney Co. also licenses its foreign language versions of channels into European countries from London (Mayes, 2017).

These are just a few examples of how important London is for Europe’s media industry. And the spill-over benefits that these media activities in London create to other areas like post-production and technical services are easy to imagine. London developed into the media capital of Europe for different reasons. However, one of the most significant reasons is that London is currently the go-to place for media companies to do operations in Europe. This, however, falls away with Brexit. There are several factors that media companies now have to consider as Brexit changes how they operate in London:

- Uncertainty and destabilization of the markets: The longer the uncertainties about the Brexit prevail, the longer there is uncertainty for London-based media companies .Operations have to go on and budgets need to be planned for the coming years. Media companies need certainty to plan, so a more secure place for operations seems the right choice. The weakened British pound already influences the markets for acquisition and media companies have to react. In the future, after Brexit, foreign investment will be harder to obtain in the UK. According to the Commercial Broadcasting Association (COBA), losing access to EU markets through Brexit could cost the UK’s television market £1 billion per year in investment from international broadcasters (Jarret, 2018). A report by Enders Analysis found that if the UK left in October without a deal, advertising spending in the UK would decline by 3% (for 2019) (Sweney, 2019).

- Increasing complex regulations: With the UK leaving the EU, regulations that highly impacted media activities in London will change. With the hard Brexit becoming more and more realistic, a lot of new regulations that as yet need to be figured out by the UK will come, as London’s media companies might not get access to the European Digital Single Market. Without EU’s Open Border policy, international talent will also be hindered if they wanted to move to London. And the EU’s Country of Origin (COO) principle of the Audio-Visual Media Service Directive (AVMSD) could not be applied for UK-based broadcasters anymore. This means that from UK broadcasted content would not be included in EU quotas. Additionally, the UK would still have to adopt many EU regulations that allow the media industry to have access to the EU markets. This makes regulations increasingly complex in the UK for media firms. At the same time, the UK no longer be able to influence new EU regulations in the interest of their local media firms. Media companies will have to react to these possible restrictions to the existing regulations and will also need to cope with complicated regulations that may replace them.

- Restrictions to EU subsidies: The media industry is highly reliant on subsidies, and the EU is a big money-giver to media activities. With Brexit, London’s media companies might not get access to EU funding, such as Creative Europe, Horizon 2020 programs, and MEDIA. According to Creative Europe Desk UK, the UK has been involved in 44% of all projects funded by Creative Europe and received 11% of the budget for the period 2014 to 2016 (its budget being €1.46 billion for 2014 to 2020) (Popple, 2018). On a positive note, the UK is also known as a strong supplier of media subsidies and was restricted by EU regulations. After Brexit, the UK will be free to spend as much money as they want. However, London’s media companies have to decide now how important EU funding mechanisms are for them and if prospects of future subsidies from other sources is enough to keep their operations running in the coming years. Neither will London-based media firms be able to use the European media content branding and labelling anymore.

Figure 1: The influence of Brexit on London’s media industry.

European countries wooing for London’s media firms

Because of the above-mentioned reasons, many businesses are currently considering relocating from the UK. The first businesses reacting to Brexit are international media firms looking to build a subsidiary headquarters in Europe. London will not be their first choice anymore. Smaller media firms and independents that are highly reliant on EU access and subsidies are also easily able to move their operations. Bigger media firms located in London have already, or will very soon have to decide whether to, relocate parts of their operations onto the European mainland.

Many European countries have already recognized the opportunity of attracting London’s media industry and consultancies are preparing to help businesses with relocation plans. UK-based media consultancy, Expert Media Partners for instance, put out a report analysing different destinations, listing Ireland, the Netherlands, Luxembourg, Malta and Estonia as the top destinations for UK broadcasters (Mann, 2018). Amongst the reasons for the attractiveness of these countries is that local and national governments have taken positive actions to attract media businesses. Here are some examples of different strategies that are currently in place:

The Netherlands and Amsterdam: The Netherlands Foreign Investment Agency (NFIA) under the Ministry of Economic Affairs has been put in charge by the national government of attracting companies from London through lobbying. The Agency has a bureau in London that was expanded as soon as the Referendum’s results were announced. The Agency actively targets companies from all industries which are active in the European market, including the media industry in London. Additionally, the Netherlands works closely with, and are favoured by, consultancies like EY, KPMG and PwC who advise UK companies about the benefits of different office locations in European cities. The NFIA stated that it has been in contact with over 200 foreign companies that are considering a possible switch to the Netherlands following Brexit -and amongst them are several companies in the broadcasting and media industry (McDonald, 2018). On a city level, a lot of things also happen; Kajsa Ollongren, Amsterdam’s Deputy Mayor in charge of Economic Affairs has reportedly made several trips to London to hold talks with media companies that might consider Amsterdam as an alternative business location (Mayes, 2017; Stewart, 2016).

Germany and Berlin: Germany made the news directly after the Referendum. Germany’s Free Democratic party ran an ad on the side of a white truck travelling around East London reading, “Dear startups, keep calm and move to Berlin” encouraging new media firms and start-ups to move to Berlin. This was followed in November by Berlin Partner, the capital’s marketing agency, running a pop-up lab in Soho highlighting what Berlin has to offer to start-ups (Oltermann, 2016).

Ireland and Dublin: Ireland has also strongly focused its strategy on attracting London’s media industry. Since 2017, the Broadcasting Authority of Ireland has intensely focused on having talks and meetings with international media companies to assess their options in Dublin. Michael O’ Keeffee, the chief executive of the Broadcasting Authority has been put in charge of such negotiations (Mayes, 2017). Besides the Broadcasting Authority of Ireland, other public bodies are also striving to support Ireland and Dublin as the go-to place after Brexit. Already in the direct aftermath of the Referendum, Martin Shanahan, the Head of Ireland’s Industrial Development Authority, has toured the USA and China to sell Dublin as the new gateway to the EU. In October 2016, Ireland’s Department of Finance started the “Getting Ireland Brexit Ready” programme that involved a couple of state ministries outlining budgets that enable Ireland to best benefit from the Brexit (O’Carroll, 2016).

Belgium and Brussels: Several working groups have been formed after the referendum last year. This includes the Belgian “Brexit High Level Group” and the Brexit-Task Force of the FOD Economie, along with working groups of other institutions like the National Bank. Most of these groups are working on protecting Belgium’s economy through the storm of the Brexit. In 2017, the Brussels government approved the creation of a working group to deal with the impact of Brexit. Cécile Jodogne, external Trade Secretary was put in charge, with the mission to position and promote Brussels as an attractive location for financial services, company headquarters and the media among other businesses. Seminars have been organized in London, as well as Korea, India, Japan and the USA (Haynes, 2017).

Conclusion

Brexit will have and already has had an impact on UK’s media industry. And we can foresee that as long as the uncertainties of the outcome of the Brexit negotiations prevail, the local media industry and businesses will also have to deal with these uncertainties and start to make decisions about relocating to European mainland. The first major relocation has recently become public, with Discovery announcing that it would shut down its European broadcasting base in London. The US TV broadcaster who broadcasts more than 100 TV channels across Europe is looking at options in Amsterdam and Warsaw. This will affect up to 100 jobs in the UK, although it will continue to employ 1,300 people in the UK, as it makes programmes and broadcasts 16 channels to British viewers (Sweney, 2018). But no doubt Discovery will not be the only broadcaster to relocate.

The Ofcom Chief Executive, Sharon White, revealed that a number of major UK-based broadcasters have told her they have contingency plans to move editorial functions to other cities in Europe (Sweney, 2018). It can be claimed that there is no single obvious alternative location to the UK for media industry businesses, which offers access to creative and technical skills, broadcasting infrastructure, airport links, and the English language. But we can for sure say that because of Brexit, more relocations of broadcasters and other media businesses will affect the UK economy in the long run.

References

Expert Media Partners. (2017). Brexit Threatens UK TV Industry in 2017.

Haynes, H. (2017, February 27). Brussels region sets up working group on Brexit issues. The Bulletin.

Hoyler, M. & Watson, A. (2012). Global media cities in transnational media networks. Tijdschrift voor economische en sociale geografie, 104(1), 90-108.

Jarret, G. (2018, August 2). Brexit: Media industry concerns. IBC 356.

Komorowski, M. (2017). A novel typology of media clusters. European Planning Studies, 25(8), 1334–1356.

London’s Economic Plan. (2017). London’s Media Industry. Retrieved 24 August 2017, from http://www.uncsbrp.org/media.htm

Mann, C. (2019). EMP: Top 5 EU jurisdictions for broadcasters post-Brexit. Advanced Television.

Mayes, J. (2017, August 8). Brexit Limbo Leads London Broadcasters to Size Up Amsterdam Digs. Bloomberg.

McDonald, A. (2018, November 15). How Brexit will impact the TV sector. Television Business International.

O’Carroll, L. (2016, October 17). Dublin exploits Brexit uncertainty to lure firms from London. The Guardian.

Oltermann, P. (2016, September 7). Berlin is beckoning to Britain’s startups. But will they leave London? The Guardian.

Popple, L. (2018). The future of UK media and entertainment after Brexit. Taylor Wessig. https://www.taylorwessing.com/download/article-media-entertainment-after-brexit.html

Stewart, J. B. (2016, June 30). Going Dutch: will Amsterdam grab a slice of the post-Brexit cake? The Guardian.

Sweney, M. (2019, January 14). UK advertising market faces recession under no-deal Brexit. The Guardian.

About the author

Marlen Komorowski is researcher at imec–SMIT–VUB and impact analyst at Cardiff University. In Cardiff, she is in charge of the research and analysis of the Clwstwr Programme, a 5-year funding scheme for the local creative industry. In Brussels, her research focusses on creative and media industry research looking at policy, economic impact, clustering, economic geography and innovation.

Contact marlen.komorowski@vub.be or komorowskim@cardiff.ac.uk for more information.

Acknowledgement

The here-presented article is based on a Policy Brief published by imec-SMIT-VUB and has been updated for this article. Please find the Policy Brief via this link.